Maharashtra Board Solutions for Chapter: Financial Planning, Exercise 5: Problem Set

Maharashtra Board Mathematics Solutions for Exercise - Maharashtra Board Solutions for Chapter: Financial Planning, Exercise 5: Problem Set

Attempt the practice questions on Chapter 4: Financial Planning, Exercise 5: Problem Set with hints and solutions to strengthen your understanding. Algebra Standard X solutions are prepared by Experienced Embibe Experts.

Questions from Maharashtra Board Solutions for Chapter: Financial Planning, Exercise 5: Problem Set with Hints & Solutions

A dealer supplied Walky-Talky set of (with GST) to police control room. Rate of GST is Find the amount of state and central GST charged by the dealer.

A wholesaler purchased electric goods for the taxable amount of He sold it to the retailer for the taxable amount of Retailer sold it to the customer for the taxable amount of Rate of GST is Show the computation of GST in tax invoices of sales. Also find the payable CGST for wholesaler and retailer.

Anna Patil (Thane, Maharashtra) supplied vacuum cleaner to a shopkeeper in Vasai (Mumbai) for the taxable value of , and GST rate of . Shopkeeper sold it to the customer at the same GST rate for (taxable value). If the amount of CGST and SGST shown in the tax invoice issued by Anna Patil is , find .

Anna Patil (Thane, Maharashtra) supplied vacuum cleaner to a shopkeeper in Vasai (Mumbai) for the taxable value of and GST rate of Shopkeeper sold it to the customer at the same GST rate for (taxable value) .Find the following - Amount of CGST and SGST charged by the shopkeeper in Vasai.

Anna Patil (Thane, Maharashtra) supplied vacuum cleaner to a shopkeeper in Vasai (Mumbai) for the taxable value of and GST rate of Shopkeeper sold it to the customer at the same GST rate for (taxable value). If the CGST and SGST payable by shopkeeper in Vasai at the time of filing the return is , find .

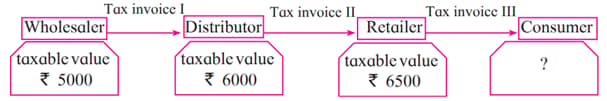

For the given trading chain prepare the tax invoice . GST at the rate of was charged for the article supplied.

Prepare the statement of GST payable under each head by the wholesaler, distributor and retailer at the time of filing the return to the government.

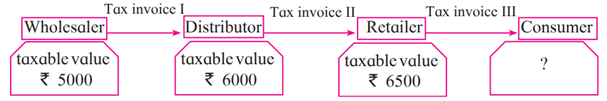

For the given trading chain prepare the tax invoice . GST at the rate of was charged for the article supplied.

At the end what amount is paid by the consumer?

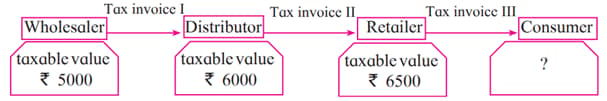

For the given trading chain prepare the tax invoice I, II, III. GST at the rate of was charged for the article supplied.

Write which of the invoices issued are and ?